- g

Dealogic DCM analytics data - DCM | gimi9.com

- gimi9.com

Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteDealogic DCM analytics data - DCM | gimi9.com [Dataset]. https://gimi9.com/dataset/eu_dealogic-dcm-analytics-data-dcm/License

CiteDealogic DCM analytics data - DCM | gimi9.com [Dataset]. https://gimi9.com/dataset/eu_dealogic-dcm-analytics-data-dcm/LicenseCC0 1.0 Universal Public Domain Dedicationhttps://creativecommons.org/publicdomain/zero/1.0/

License information was derived automaticallyDescription🇪🇺 유럽연합

- e

Аналитические данные Dealogic DCM | Dealogic DCM analytics data - Dataset -...

- repository.econdata.tech

Updated Sep 10, 2025 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied Cite(2025). Аналитические данные Dealogic DCM | Dealogic DCM analytics data - Dataset - Репозиторий данных [Dataset]. https://repository.econdata.tech/dataset/dealogic-dcm-analytics-dataDataset updatedSep 10, 2025Description

Cite(2025). Аналитические данные Dealogic DCM | Dealogic DCM analytics data - Dataset - Репозиторий данных [Dataset]. https://repository.econdata.tech/dataset/dealogic-dcm-analytics-dataDataset updatedSep 10, 2025DescriptionАналитические данные Dealogic DCM (выпуск прекращен) (22) Характеристика сроков погашения находящихся в обращении долговых ценных бумаг и долгосрочных долговых ценных бумаг, выпущенных банками ЕС (во всех валютах вместе взятых) Dealogic DCM analytics data (discontinued) (22) Maturity profile of outstanding debt securities and long-term debt securities issuance by EU banks (all currencies combined)

- D

Dispersion Compensation Modules (DCM) Report

- datainsightsmarket.com

doc, pdf, pptUpdated Feb 14, 2025 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteData Insights Market (2025). Dispersion Compensation Modules (DCM) Report [Dataset]. https://www.datainsightsmarket.com/reports/dispersion-compensation-modules-dcm-1691790doc, ppt, pdfAvailable download formatsDataset updatedFeb 14, 2025Dataset authored and provided byData Insights MarketLicense

CiteData Insights Market (2025). Dispersion Compensation Modules (DCM) Report [Dataset]. https://www.datainsightsmarket.com/reports/dispersion-compensation-modules-dcm-1691790doc, ppt, pdfAvailable download formatsDataset updatedFeb 14, 2025Dataset authored and provided byData Insights MarketLicensehttps://www.datainsightsmarket.com/privacy-policyhttps://www.datainsightsmarket.com/privacy-policy

Time period covered2025 - 2033Area coveredGlobalVariables measuredMarket SizeDescriptionThe size of the Dispersion Compensation Modules (DCM) market was valued at USD XXX million in 2024 and is projected to reach USD XXX million by 2033, with an expected CAGR of XX% during the forecast period.

dcm.com.br Website Traffic, Ranking, Analytics [October 2025]

- semrush.ebundletools.com

Updated Nov 12, 2025 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteSemrush (2025). dcm.com.br Website Traffic, Ranking, Analytics [October 2025] [Dataset]. https://semrush.ebundletools.com/website/dcm.com.br/overview/Dataset updatedNov 12, 2025License

CiteSemrush (2025). dcm.com.br Website Traffic, Ranking, Analytics [October 2025] [Dataset]. https://semrush.ebundletools.com/website/dcm.com.br/overview/Dataset updatedNov 12, 2025Licensehttps://semrush.ebundletools.com/company/legal/terms-of-service/https://semrush.ebundletools.com/company/legal/terms-of-service/

Time period coveredNov 12, 2025Area coveredWorldwideVariables measuredvisits, backlinks, bounceRate, pagesPerVisit, authorityScore, organicKeywords, avgVisitDuration, referringDomains, trafficByCountry, paidSearchTraffic, and 3 moreMeasurement techniqueSemrush Traffic Analytics; Click-stream dataDescriptiondcm.com.br is ranked #3064 in BR with 767.18K Traffic. Categories: Online Services. Learn more about website traffic, market share, and more!

- D

Investor Targeting For ECM/DCM Market Research Report 2033

- dataintelo.com

csv, pdf, pptxUpdated Sep 30, 2025 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteDataintelo (2025). Investor Targeting For ECM/DCM Market Research Report 2033 [Dataset]. https://dataintelo.com/report/investor-targeting-for-ecmdcm-marketcsv, pdf, pptxAvailable download formatsDataset updatedSep 30, 2025Dataset authored and provided byDatainteloLicense

CiteDataintelo (2025). Investor Targeting For ECM/DCM Market Research Report 2033 [Dataset]. https://dataintelo.com/report/investor-targeting-for-ecmdcm-marketcsv, pdf, pptxAvailable download formatsDataset updatedSep 30, 2025Dataset authored and provided byDatainteloLicensehttps://dataintelo.com/privacy-and-policyhttps://dataintelo.com/privacy-and-policy

Time period covered2024 - 2032Area coveredGlobalDescriptionInvestor Targeting for ECM/DCM Market Outlook

According to our latest research, the global Investor Targeting for ECM/DCM market size reached USD 2.85 billion in 2024, with a robust compound annual growth rate (CAGR) of 13.2% projected from 2025 to 2033. By the end of 2033, the market is anticipated to reach USD 8.34 billion, driven by increasing digital transformation across capital markets and the integration of advanced analytics and AI-driven investor targeting solutions. This growth is underpinned by the rising demand for precision in investor outreach and the need for optimized capital raising strategies in both Equity Capital Markets (ECM) and Debt Capital Markets (DCM).

One of the primary growth factors propelling the Investor Targeting for ECM/DCM market is the accelerating adoption of digital technologies and automation within financial institutions. As capital markets become increasingly complex, the volume and diversity of investors have soared, necessitating sophisticated targeting solutions. Financial organizations are leveraging AI-powered analytics, big data, and machine learning algorithms to identify, segment, and engage investors with unprecedented accuracy. This not only enhances deal execution but also improves investor relations and compliance. The integration of such advanced technologies allows market participants to streamline their targeting processes, reduce manual intervention, and achieve better alignment between issuers and potential investors, thus fueling market growth.

Another significant growth driver is the heightened regulatory scrutiny and transparency requirements in global capital markets. Regulatory bodies across North America, Europe, and Asia Pacific are imposing stricter disclosure norms and demanding greater transparency in investor communication and capital raising activities. This regulatory landscape compels financial institutions to adopt comprehensive investor targeting solutions that ensure compliance, minimize risks, and maintain robust audit trails. As a result, demand for platforms and services that facilitate secure, compliant, and transparent investor engagement is surging. This trend is especially pronounced among large enterprises and investment banks, which are under constant pressure to demonstrate due diligence and maintain investor trust.

The evolving preferences and expectations of investors themselves are also shaping the growth trajectory of the Investor Targeting for ECM/DCM market. Today’s investors expect personalized communication, timely information, and seamless digital experiences. This has led to the emergence of omni-channel targeting strategies, where financial advisors and corporates deploy a mix of digital and traditional channels to reach and engage their target audience. The competitive nature of capital markets means issuers must differentiate themselves by leveraging data-driven insights and tailored outreach, further boosting the need for advanced investor targeting solutions. Additionally, the growing participation of retail and institutional investors in ECM and DCM activities is expanding the addressable market for these solutions.

From a regional perspective, North America continues to dominate the Investor Targeting for ECM/DCM market, accounting for the largest share in 2024. This dominance is attributed to the presence of major financial centers, high levels of technology adoption, and a mature regulatory environment. However, the Asia Pacific region is emerging as the fastest-growing market, fueled by rapid economic development, increasing capital market activity, and digital transformation initiatives across key economies such as China, India, and Singapore. Europe, with its strong regulatory frameworks and established capital markets, also contributes significantly to global market growth. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual adoption, supported by ongoing financial sector reforms and investments in digital infrastructure.Component Analysis

The Investor Targeting for ECM/DCM market is segmented by component into Software, Services, and Platforms, each playing a distinct and critical role in the overall ecosystem. The Software segment encompasses a wide range of solutions, including AI-powered analytics tools, CRM systems, and investor profiling applications. These software solutions are designed to automate and opt - D

Document Case Management Industry Report

- marketreportanalytics.com

doc, pdf, pptUpdated Apr 21, 2025 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteMarket Report Analytics (2025). Document Case Management Industry Report [Dataset]. https://www.marketreportanalytics.com/reports/document-case-management-industry-88568doc, pdf, pptAvailable download formatsDataset updatedApr 21, 2025Dataset authored and provided byMarket Report AnalyticsLicense

CiteMarket Report Analytics (2025). Document Case Management Industry Report [Dataset]. https://www.marketreportanalytics.com/reports/document-case-management-industry-88568doc, pdf, pptAvailable download formatsDataset updatedApr 21, 2025Dataset authored and provided byMarket Report AnalyticsLicensehttps://www.marketreportanalytics.com/privacy-policyhttps://www.marketreportanalytics.com/privacy-policy

Time period covered2025 - 2033Area coveredGlobalVariables measuredMarket SizeDescriptionThe Document Case Management market is booming, projected to reach $6.3 Billion by 2033 with a 15.2% CAGR. Learn about key drivers, trends, restraints, and leading companies shaping this dynamic industry. Explore regional market shares and growth projections for North America, Europe, and Asia Pacific. Recent developments include: March 2022 - Post-pandemic Xerox Corporation relaunched an electronic document management system that improves productivity and fosters an intelligent workplace. Customers in both private and public institutions can use the system to create an effective workplace., October 2021 - The SaaS firm Spyder Inc. declared the extension of its product line of document storage solutions. For producers and small businesses, Spyder introduced an online document storage option. Its purposeful design was created to meet the needs of corporate financial services and insurance firms.. Key drivers for this market are: Increasing Need for Securing Confidential Data and Protection Against Data Loss, Growing Demand for Improving Archived Content across Channels; Ongoing efforts to promote Digitization at Workplaces. Potential restraints include: Increasing Need for Securing Confidential Data and Protection Against Data Loss, Growing Demand for Improving Archived Content across Channels; Ongoing efforts to promote Digitization at Workplaces. Notable trends are: BFSI to Occupy a Significant Market Share.

- d

DCM analysis of a fresh ore particle before leaching

- data.gov.au

css, html, javascript +4Updated Jul 5, 2020+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteThe Commonwealth Scientific and Industrial Research Organisation (2020). DCM analysis of a fresh ore particle before leaching [Dataset]. https://data.gov.au/dataset/ds-dap-csiro%3A42639css, png, pdf, jpeg, html, xhtml, javascriptAvailable download formatsDataset updatedJul 5, 2020Dataset provided byThe Commonwealth Scientific and Industrial Research OrganisationDescription

CiteThe Commonwealth Scientific and Industrial Research Organisation (2020). DCM analysis of a fresh ore particle before leaching [Dataset]. https://data.gov.au/dataset/ds-dap-csiro%3A42639css, png, pdf, jpeg, html, xhtml, javascriptAvailable download formatsDataset updatedJul 5, 2020Dataset provided byThe Commonwealth Scientific and Industrial Research OrganisationDescriptionDCM analysis of a re-constructed synchrotron X-CT image from “leach cup” C (10 g/L [H2SO4], 2 g/L [Fe3+]) of a fresh ore particle before leaching showing a) sulfide phases (blue), b) non-sulfide …Show full descriptionDCM analysis of a re-constructed synchrotron X-CT image from “leach cup” C (10 g/L [H2SO4], 2 g/L [Fe3+]) of a fresh ore particle before leaching showing a) sulfide phases (blue), b) non-sulfide gangue phases (red), c) void phases (green) and d) combined reconstruction phases. The DCM analysis was conducted on a representative grid (200 x 200 x 100 voxel) The metadata and files (if any) are available to the public.

- T

Telematic Control Unit DCM Report

- datainsightsmarket.com

doc, pdf, pptUpdated Dec 30, 2024 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteData Insights Market (2024). Telematic Control Unit DCM Report [Dataset]. https://www.datainsightsmarket.com/reports/telematic-control-unit-dcm-767390doc, pdf, pptAvailable download formatsDataset updatedDec 30, 2024Dataset authored and provided byData Insights MarketLicense

CiteData Insights Market (2024). Telematic Control Unit DCM Report [Dataset]. https://www.datainsightsmarket.com/reports/telematic-control-unit-dcm-767390doc, pdf, pptAvailable download formatsDataset updatedDec 30, 2024Dataset authored and provided byData Insights MarketLicensehttps://www.datainsightsmarket.com/privacy-policyhttps://www.datainsightsmarket.com/privacy-policy

Time period covered2025 - 2033Area coveredGlobalVariables measuredMarket SizeDescriptionThe size of the Telematic Control Unit DCM market was valued at USD XXX million in 2023 and is projected to reach USD XXX million by 2032, with an expected CAGR of XX% during the forecast period.

- i

Dilated Cardiomyopathy (DCM) Market Outlook, Trends And Future Opportunities...

- idataacumen.com

Updated Oct 5, 2023 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteiDataAcumen (2023). Dilated Cardiomyopathy (DCM) Market Outlook, Trends And Future Opportunities (2023-2030) [Dataset]. https://www.idataacumen.com/industry-analysis/dilated-cardiomyopathy-marketDataset updatedOct 5, 2023Dataset authored and provided byiDataAcumenLicense

CiteiDataAcumen (2023). Dilated Cardiomyopathy (DCM) Market Outlook, Trends And Future Opportunities (2023-2030) [Dataset]. https://www.idataacumen.com/industry-analysis/dilated-cardiomyopathy-marketDataset updatedOct 5, 2023Dataset authored and provided byiDataAcumenLicensehttps://www.idataacumen.com/privacy-policyhttps://www.idataacumen.com/privacy-policy

Time period covered2023 - 2030Area coveredGlobalDescriptionDilated Cardiomyopathy (DCM) Market, By Therapeutics (Aldosterone antagonists, Angiotensin-converting enzyme (ACE) Inhibitors, Angiotensin II Receptor Blockers, Beta-blockers, Others), By Distribution Channel (Hospitals Pharmacies, Retail Pharmacies, Online Pharmacies), Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) The report offers a comprehensive view of the market from supply as well as demand side to help take informed decisions.

- G

Loan Analytics Market Research Report 2033

- growthmarketreports.com

csv, pdf, pptxUpdated Aug 29, 2025 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteGrowth Market Reports (2025). Loan Analytics Market Research Report 2033 [Dataset]. https://growthmarketreports.com/report/loan-analytics-marketpptx, csv, pdfAvailable download formatsDataset updatedAug 29, 2025Dataset authored and provided byGrowth Market ReportsTime period covered2024 - 2032Area coveredGlobalDescription

CiteGrowth Market Reports (2025). Loan Analytics Market Research Report 2033 [Dataset]. https://growthmarketreports.com/report/loan-analytics-marketpptx, csv, pdfAvailable download formatsDataset updatedAug 29, 2025Dataset authored and provided byGrowth Market ReportsTime period covered2024 - 2032Area coveredGlobalDescriptionLoan Analytics Market Outlook

According to our latest research, the global loan analytics market size reached USD 8.4 billion in 2024, driven by the accelerating digital transformation in the financial sector and the growing need for advanced data-driven decision-making tools. The market is expected to expand at a robust CAGR of 16.2% during the forecast period, reaching USD 38.5 billion by 2033. Key growth factors include the proliferation of big data, the adoption of AI and machine learning for risk assessment, and stringent regulatory requirements compelling financial institutions to enhance their loan management processes. As per our latest research, the market is poised for significant growth as banks, NBFCs, and other lenders increasingly leverage analytics to optimize lending operations, improve customer experience, and ensure compliance.

One of the primary growth drivers for the loan analytics market is the exponential rise in digital lending and the corresponding need for real-time insights. Financial institutions are under constant pressure to mitigate risks and make faster, data-driven lending decisions in an increasingly competitive landscape. The integration of advanced analytics, including predictive modeling and AI-driven scoring, enables lenders to assess borrower risk profiles with greater accuracy, reduce default rates, and streamline loan approval processes. Moreover, the ongoing shift towards digital banking platforms has created vast datasets, further fueling the demand for sophisticated analytics solutions that can extract actionable intelligence, enhance credit assessments, and personalize loan offerings.

Another significant factor bolstering the loan analytics market is the tightening regulatory environment across major economies. As governments and regulatory bodies introduce more stringent compliance requirements related to lending practices, anti-money laundering (AML), and fair lending, financial institutions are compelled to invest in robust analytics platforms. These solutions assist in automating compliance checks, generating audit trails, and ensuring adherence to evolving standards. This regulatory push not only mitigates the risk of penalties and reputational damage but also encourages the adoption of analytics solutions that can proactively identify compliance gaps, monitor transaction patterns, and generate timely alerts for suspicious activities.

Additionally, the growing focus on customer-centricity and operational efficiency is propelling the adoption of loan analytics in both established and emerging markets. Lenders are increasingly leveraging analytics to segment customers, predict borrowing needs, and tailor loan products to specific demographics. By harnessing data from multiple sources, including credit bureaus, social media, and transaction histories, financial institutions can offer more personalized loan terms, improve cross-selling opportunities, and enhance customer retention. The automation of loan origination, underwriting, and servicing processes through analytics not only reduces operational costs but also accelerates turnaround times, leading to heightened customer satisfaction and competitive differentiation.The integration of Loan Pricing and Profitability Analytics is becoming increasingly crucial for financial institutions aiming to enhance their competitive edge. By leveraging these analytics, lenders can gain deeper insights into the profitability of their loan products and adjust pricing strategies accordingly. This approach not only helps in optimizing revenue streams but also in aligning loan offerings with market demand and customer expectations. As financial institutions strive for greater efficiency, the ability to analyze and predict profitability at a granular level becomes a key differentiator. This ensures that lenders can offer competitive rates while maintaining healthy margins, ultimately contributing to sustainable growth in the loan analytics market.

Regionally, North America continues to dominate the global loan analytics market, accounting for the largest share in 2024, followed closely by Europe and Asia Pacific. The high adoption rate of advanced analytics solutions among large banks and fintech companies, combined with a mature digital infrastructure and proactive regulatory frameworks, has positioned North America as a fr - f

Table1_Exploring the etiology of dilated cardiomyopathy using Mendelian...

- frontiersin.figshare.com

xlsxUpdated Aug 26, 2024+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteSiYang Xue; HongJu Jiang (2024). Table1_Exploring the etiology of dilated cardiomyopathy using Mendelian randomization.xlsx [Dataset]. http://doi.org/10.3389/fcvm.2024.1364126.s001xlsxAvailable download formatsUnique identifierhttps://doi.org/10.3389/fcvm.2024.1364126.s001Dataset updatedAug 26, 2024Dataset provided byFrontiersAuthorsSiYang Xue; HongJu JiangLicense

CiteSiYang Xue; HongJu Jiang (2024). Table1_Exploring the etiology of dilated cardiomyopathy using Mendelian randomization.xlsx [Dataset]. http://doi.org/10.3389/fcvm.2024.1364126.s001xlsxAvailable download formatsUnique identifierhttps://doi.org/10.3389/fcvm.2024.1364126.s001Dataset updatedAug 26, 2024Dataset provided byFrontiersAuthorsSiYang Xue; HongJu JiangLicenseAttribution 4.0 (CC BY 4.0)https://creativecommons.org/licenses/by/4.0/

License information was derived automaticallyDescriptionBackgroundObservational clinical studies suggest an association between dilated cardiomyopathy (DCM) and various factors including titin, cardiac troponin I (CTnI), desmocollin-2, the perinatal period, alcoholism, Behçet's disease, systemic lupus erythematosus, hyperthyroidism and thyrotoxicosis, hypothyroidism, carnitine metabolic disorder, and renal insufficiency. The causal nature of these associations remains uncertain. This study aims to explore these correlations using the Mendelian randomization (MR) approach.ObjectiveTo investigate the etiology of DCM through Mendelian randomization analysis.MethodsData mining was conducted in genome-wide association study databases, focusing on variant target proteins (titin, CTnI, desmocollin-2), the perinatal period, alcoholism, Behçet's disease, systemic lupus erythematosus, hyperthyroidism and thyrotoxicosis, hypothyroidism, carnitine metabolic disorder, and renal insufficiency, with DCM as the outcome. The analysis employed various regression models, namely, the inverse-variance weighted (IVW), MR-Egger, simple mode, weighted median, and weighted mode methods.ResultsThe IVW results showed a correlation between titin protein and DCM, identifying titin as a protective factor [OR = 0.856, 95% CI (0.744–0.985), P = 0.030]. CTnI protein correlated with DCM, marking it as a risk factor [OR = 1.204, 95% CI (1.010–1.436), P = 0.040]. Desmocollin-2 also correlated with DCM and was recognized as a risk factor [OR = 1.309, 95% CI (1.085–1.579), P = 0.005]. However, no causal relationship was found between the perinatal period, alcoholism, Behçet's disease, systemic lupus erythematosus, hyperthyroidism and thyrotoxicosis, hypothyroidism, carnitine metabolic disorder, renal insufficiency, and DCM (P > 0.05). The MR-Egger intercept test indicated no pleiotropy (P > 0.05), affirming the effectiveness of Mendelian randomization in causal inference.ConclusionTitin, CTnI, and desmocollin-2 proteins were identified as independent risk factors for DCM. Contrasting with previous observational studies, no causal relationship was observed between DCM and the perinatal period, alcoholism, Behçet's disease, systemic lupus erythematosus, hyperthyroidism and thyrotoxicosis, hypothyroidism, carnitine metabolic disorder, or renal insufficiency.

- m

Dispersion Compensation Modules (DCM) Market Size, Share & Industry Trends...

- marketresearchintellect.com

Updated Jun 25, 2024+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteMarket Research Intellect (2024). Dispersion Compensation Modules (DCM) Market Size, Share & Industry Trends Analysis 2033 [Dataset]. https://www.marketresearchintellect.com/product/dispersion-compensation-modules-dcm-market/Dataset updatedJun 25, 2024Dataset authored and provided byMarket Research IntellectLicense

CiteMarket Research Intellect (2024). Dispersion Compensation Modules (DCM) Market Size, Share & Industry Trends Analysis 2033 [Dataset]. https://www.marketresearchintellect.com/product/dispersion-compensation-modules-dcm-market/Dataset updatedJun 25, 2024Dataset authored and provided byMarket Research IntellectLicensehttps://www.marketresearchintellect.com/privacy-policyhttps://www.marketresearchintellect.com/privacy-policy

Area coveredGlobalDescriptionCheck Market Research Intellect's Dispersion Compensation Modules (DCM) Market Report, pegged at USD 1.2 billion in 2024 and projected to reach USD 2.5 billion by 2033, advancing with a CAGR of 9.0% (2026-2033).Explore factors such as rising applications, technological shifts, and industry leaders.

- f

Data from: Genetic analysis and family screening for dilated cardiomyopathy:...

- datasetcatalog.nlm.nih.gov

- tandf.figshare.com

Updated Jul 24, 2024 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteYlipää, Josef; Andersson, Therese (2024). Genetic analysis and family screening for dilated cardiomyopathy: a retrospective analysis of the stepwise pedigree approach [Dataset]. https://datasetcatalog.nlm.nih.gov/dataset?q=0001360236Dataset updatedJul 24, 2024AuthorsYlipää, Josef; Andersson, ThereseDescription

CiteYlipää, Josef; Andersson, Therese (2024). Genetic analysis and family screening for dilated cardiomyopathy: a retrospective analysis of the stepwise pedigree approach [Dataset]. https://datasetcatalog.nlm.nih.gov/dataset?q=0001360236Dataset updatedJul 24, 2024AuthorsYlipää, Josef; Andersson, ThereseDescriptionThis study aimed to assess the practicality of using a stepwise pedigree-based approach to differentiate between familial and sporadic Dilated Cardiomyopathy (DCM), while also considering timing of the genetic analysis. The analysis includes an examination of the extent to which complete family investigations were conducted in real-world scenarios as well as the length of the investigation. The stepwise pedigree approach involved conducting a comprehensive family history spanning 3 to 4 generations, reviewing medical records of relatives, and conducting clinical screening using echocardiography and electrocardiogram on first-degree relatives. Familial DCM was diagnosed when at least 2 family members were found to have DCM, and genetic analysis was considered as an option. This study involved a manual review of all DCM investigations conducted at the Centre of Cardiovascular Genetics at Umeå University Hospital, where the stepwise pedigree approach has been employed since 2007. The investigation process had a mean duration of 643 days (95% CI 560.5–724.9). Of the investigations preformed, 94 (68%) were complete, 12 (9%) were ongoing, and 33 (24%) were prematurely terminated and thus incomplete. At the conclusion of the investigations, 55 cases (43%) were classified as familial DCM, 50 (39%) as sporadic DCM, and 22 (18%) remained unassessed due to incomplete pedigrees. Among the familial cases, genetic verification was achieved in 40%. The stepwise pedigree approach is time consuming, and the investigations are often incomplete which may suggest that a more direct approach to genetic analysis, may be warranted.

Bank Loan Analysis Project in Mysql

- kaggle.com

zipUpdated Jul 3, 2024 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteSanjana Murthy (2024). Bank Loan Analysis Project in Mysql [Dataset]. https://www.kaggle.com/datasets/sanjanamurthy392/bank-loan-analysis-project-in-mysqlzip(739 bytes)Available download formatsDataset updatedJul 3, 2024AuthorsSanjana MurthyLicense

CiteSanjana Murthy (2024). Bank Loan Analysis Project in Mysql [Dataset]. https://www.kaggle.com/datasets/sanjanamurthy392/bank-loan-analysis-project-in-mysqlzip(739 bytes)Available download formatsDataset updatedJul 3, 2024AuthorsSanjana MurthyLicenseAttribution-NonCommercial 4.0 (CC BY-NC 4.0)https://creativecommons.org/licenses/by-nc/4.0/

License information was derived automaticallyDescriptionAbout Datasets:

Domain : Finance Project: Bank loan of customers Datasets: Finance_1.xlsx & Finance_2.xlsx Dataset Type: Excel Data Dataset Size: Each Excel file has 39k+ records KPI's:

Year wise loan amount Stats Grade and sub grade wise revol_bal Total Payment for Verified Status Vs Total Payment for Non Verified Status State wise loan status Month wise loan status Get more insights based on your understanding of the data Process:

Understanding the problem Data Collection Data Cleaning Exploring and analyzing the data Interpreting the results

This data contains create database, select count * from, select * from, limit, select year as, group by, order by, inner join on, concat, round, sum, format, desc.

- m

Telematic Control Unit DCM Market Size, Share & Future Trends Analysis 2033

- marketresearchintellect.com

Updated Jun 25, 2024+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteMarket Research Intellect (2024). Telematic Control Unit DCM Market Size, Share & Future Trends Analysis 2033 [Dataset]. https://www.marketresearchintellect.com/product/telematic-control-unit-dcm-market/Dataset updatedJun 25, 2024Dataset authored and provided byMarket Research IntellectLicense

CiteMarket Research Intellect (2024). Telematic Control Unit DCM Market Size, Share & Future Trends Analysis 2033 [Dataset]. https://www.marketresearchintellect.com/product/telematic-control-unit-dcm-market/Dataset updatedJun 25, 2024Dataset authored and provided byMarket Research IntellectLicensehttps://www.marketresearchintellect.com/privacy-policyhttps://www.marketresearchintellect.com/privacy-policy

Area coveredGlobalDescriptionAccess Market Research Intellect's Telematic Control Unit DCM Market Report for insights on a market worth USD 3.5 billion in 2024, expanding to USD 7.4 billion by 2033, driven by a CAGR of 9.2%.Learn about growth opportunities, disruptive technologies, and leading market participants.

- G

Collateralized Loan Obligation Analytics Market Research Report 2033

- growthmarketreports.com

csv, pdf, pptxUpdated Sep 1, 2025+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteGrowth Market Reports (2025). Collateralized Loan Obligation Analytics Market Research Report 2033 [Dataset]. https://growthmarketreports.com/report/collateralized-loan-obligation-analytics-marketcsv, pptx, pdfAvailable download formatsDataset updatedSep 1, 2025Dataset authored and provided byGrowth Market ReportsTime period covered2024 - 2032Area coveredGlobalDescription

CiteGrowth Market Reports (2025). Collateralized Loan Obligation Analytics Market Research Report 2033 [Dataset]. https://growthmarketreports.com/report/collateralized-loan-obligation-analytics-marketcsv, pptx, pdfAvailable download formatsDataset updatedSep 1, 2025Dataset authored and provided byGrowth Market ReportsTime period covered2024 - 2032Area coveredGlobalDescriptionCollateralized Loan Obligation (CLO) Analytics Market Outlook

According to our latest research, the global Collateralized Loan Obligation (CLO) Analytics market size reached USD 1.62 billion in 2024 and is expected to grow at a robust CAGR of 13.8% during the forecast period, reaching USD 4.41 billion by 2033. This dynamic expansion is driven by the increasing complexity of CLO structures, the need for advanced risk management tools, and the rising adoption of digital analytics platforms in the financial sector. As per our analysis, the market is experiencing strong momentum due to regulatory compliance requirements and the growing demand for real-time portfolio insights.

One of the primary growth factors for the Collateralized Loan Obligation (CLO) Analytics market is the escalating need for sophisticated risk management solutions. With the evolving nature of CLO transactions and the increasing volume of leveraged loans, financial institutions require robust analytics platforms to assess, monitor, and mitigate risks effectively. The integration of artificial intelligence and machine learning into analytics tools enables financial professionals to identify patterns, forecast potential defaults, and optimize asset allocations. This technological advancement not only enhances risk assessment capabilities but also ensures regulatory compliance, which is critical in todayÂ’s highly scrutinized financial environment. The demand for such advanced analytics is further amplified by the growing complexity of CLO tranches and the necessity to evaluate cash flow scenarios in real time.

Another significant driver propelling the CLO Analytics market forward is the intensifying focus on portfolio management and performance optimization. Asset managers and institutional investors are increasingly leveraging analytics platforms to gain granular insights into the underlying assets of CLO portfolios. These tools facilitate scenario analysis, stress testing, and performance benchmarking, allowing stakeholders to make informed investment decisions. The ability to track and analyze portfolio performance at a granular level not only enhances transparency but also fosters investor confidence. As competition within the asset management sector intensifies, firms are investing heavily in analytics solutions to differentiate their offerings and deliver superior returns to clients.

The surge in regulatory scrutiny and the need for comprehensive compliance and reporting solutions also contribute significantly to market growth. Regulatory bodies across North America, Europe, and Asia Pacific have implemented stringent guidelines for CLO transactions, necessitating accurate, timely, and transparent reporting. Analytics platforms equipped with compliance modules enable financial institutions to automate reporting processes, reduce manual errors, and ensure adherence to evolving regulations. This not only streamlines operations but also minimizes the risk of non-compliance penalties. As regulatory frameworks continue to evolve, the demand for agile and scalable analytics solutions is expected to rise, further fueling market expansion.Investment Analytics plays a crucial role in the evolving landscape of the Collateralized Loan Obligation (CLO) Analytics market. As financial institutions strive to optimize their portfolios and enhance decision-making processes, the integration of investment analytics tools becomes increasingly significant. These tools provide comprehensive insights into market trends, asset performance, and risk factors, enabling stakeholders to make informed investment decisions. By leveraging investment analytics, asset managers can identify lucrative opportunities, mitigate potential risks, and achieve superior returns. The growing emphasis on data-driven strategies and real-time insights underscores the importance of investment analytics in navigating the complexities of the CLO market. As the demand for sophisticated analytics solutions continues to rise, investment analytics is poised to become a cornerstone of financial innovation and growth.

From a regional perspective, North America dominates the Collateralized Loan Obligation (CLO) Analytics market with a substantial market share, followed by Europe and Asia Pacific. The presence of major financial hubs, advanced technolog DCM datasets for corrosion pits development in SLM 3D-printed SS316 samples

- researchdata.edu.au

- data.csiro.au

datadownloadUpdated May 31, 2021+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteMike Tan; Wei Xu; Jie Ma; Xufang Zhang; Haipeng Wang; Majid Laleh; Sam Yang; Tony Hughes; Jianli Li; YS Yang (2021). DCM datasets for corrosion pits development in SLM 3D-printed SS316 samples [Dataset]. http://doi.org/10.25919/4KSZ-VJ58datadownloadAvailable download formatsUnique identifierhttps://doi.org/10.25919/4KSZ-VJ58Dataset updatedMay 31, 2021AuthorsMike Tan; Wei Xu; Jie Ma; Xufang Zhang; Haipeng Wang; Majid Laleh; Sam Yang; Tony Hughes; Jianli Li; YS YangLicense

CiteMike Tan; Wei Xu; Jie Ma; Xufang Zhang; Haipeng Wang; Majid Laleh; Sam Yang; Tony Hughes; Jianli Li; YS Yang (2021). DCM datasets for corrosion pits development in SLM 3D-printed SS316 samples [Dataset]. http://doi.org/10.25919/4KSZ-VJ58datadownloadAvailable download formatsUnique identifierhttps://doi.org/10.25919/4KSZ-VJ58Dataset updatedMay 31, 2021AuthorsMike Tan; Wei Xu; Jie Ma; Xufang Zhang; Haipeng Wang; Majid Laleh; Sam Yang; Tony Hughes; Jianli Li; YS YangLicensehttps://research.csiro.au/dap/licences/csiro-data-licence/https://research.csiro.au/dap/licences/csiro-data-licence/

DescriptionThis collection contains DCM dataset files for porosity clusters and corrosion pits in selective-laser-melting (SLM) 3D-printed low- and mid-density SS316L samples which have measured relative densities of 98.77% and 99.05% respectively. The corrosion pits were formed by immersing the samples in a 6 wt% ferric chloride solution. The samples were taken out of the solution after every 8 hours for X-ray CT and DCM analysis. Lineage: X-ray CT, data-constrained modelling (DCM) micro-structure and linked cluster analysis

Bank Loan Defaulter Case Study

- kaggle.com

zipUpdated Nov 10, 2022 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteAmit Yadav (2022). Bank Loan Defaulter Case Study [Dataset]. https://www.kaggle.com/datasets/amity024/data-sourceszip(117814331 bytes)Available download formatsDataset updatedNov 10, 2022AuthorsAmit YadavDescription

CiteAmit Yadav (2022). Bank Loan Defaulter Case Study [Dataset]. https://www.kaggle.com/datasets/amity024/data-sourceszip(117814331 bytes)Available download formatsDataset updatedNov 10, 2022AuthorsAmit YadavDescriptionCredit-EDA Bank Loan Default Risk Analysis Case Study

Introduction

This assignment aims to give you an idea of applying EDA in a real business scenario. In this assignment, apart from applying the techniques that you have learnt in the EDA module, you will also develop a basic understanding of risk analytics in banking and financial services and understand how data is used to minimise the risk of losing money while lending to customers.

Business Understanding

The loan-providing companies find it hard to give loans to people due to their insufficient or non-existent credit history. Because of that, some consumers use it to their advantage by becoming a defaulter. Suppose you work for a consumer finance company which specializes in lending various types of loans to urban customers. You have to use EDA to analyze the patterns present in the data. This will ensure that the applicants capable of repaying the loan are not rejected. When the company receives a loan application, the company has to decide for loan approval based on the applicant’s profile. Two types of risks are associated with the bank’s decision:

If the applicant is likely to repay the loan, then not approving the loan results in a loss of business to the company.

If the applicant is not likely to repay the loan, i.e., he/she is likely to default, then approving the loan may lead to a financial loss for the company.

When a client applies for a loan, there are four types of decisions that could be taken by the client/company):

Approved: The Company has approved loan Application

Cancelled: The client cancelled the application sometime during approval. Either the client changed her/his mind about the loan or in some cases due to a higher risk of the client, he received worse pricing which he did not want.

Refused: The company had rejected the loan (because the client does not meet their requirements etc.).

Unused offer: Loan has been cancelled by the client but at different stages of the process.

In this case study, you will use EDA to understand how consumer attributes and loan attributes influence the tendency to default.

Business Objectives

To identify patterns which indicate if a client has difficulty paying their installments, which may be used for taking actions such as

Denying the loan, reducing the amount of loan,

Lending (to risky applicants) at a higher interest rate, etc.

This will ensure that the consumers capable of repaying the loan are not rejected. Identification of such applicants using EDA is the aim of this case study. The company wants to understand the driving factors (or driver variables) behind loan default, The company can utilize this knowledge for its portfolio and risk assessment

- N

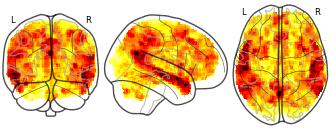

Empathy DCM 2025: Negative - Neutral

- neurovault.org

niftiUpdated Jan 28, 2025+ more versions Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied Cite(2025). Empathy DCM 2025: Negative - Neutral [Dataset]. http://identifiers.org/neurovault.image:896915niftiAvailable download formatsUnique identifierhttps://identifiers.org/neurovault.image:896915Dataset updatedJan 28, 2025License

Cite(2025). Empathy DCM 2025: Negative - Neutral [Dataset]. http://identifiers.org/neurovault.image:896915niftiAvailable download formatsUnique identifierhttps://identifiers.org/neurovault.image:896915Dataset updatedJan 28, 2025LicenseCC0 1.0 Universal Public Domain Dedicationhttps://creativecommons.org/publicdomain/zero/1.0/

License information was derived automaticallyDescriptionCollection description

Subject species

homo sapiens

Modality

fMRI-BOLD

Analysis level

group

Cognitive paradigm (task)

facial expression of emotion

Map type

T

Cotality Loan-Level Market Analytics

- redivis.com

- stanford.redivis.com

application/jsonl +7Updated Aug 15, 2024 Share

Share Facebook

Facebook Twitter

Twitter EmailClick to copy linkLink copied

EmailClick to copy linkLink copied CiteStanford University Libraries (2024). Cotality Loan-Level Market Analytics [Dataset]. http://doi.org/10.57761/a96q-1j33avro, sas, spss, stata, arrow, parquet, csv, application/jsonlAvailable download formatsUnique identifierhttps://doi.org/10.57761/a96q-1j33Dataset updatedAug 15, 2024Dataset provided byRedivis Inc.AuthorsStanford University LibrariesDescription

CiteStanford University Libraries (2024). Cotality Loan-Level Market Analytics [Dataset]. http://doi.org/10.57761/a96q-1j33avro, sas, spss, stata, arrow, parquet, csv, application/jsonlAvailable download formatsUnique identifierhttps://doi.org/10.57761/a96q-1j33Dataset updatedAug 15, 2024Dataset provided byRedivis Inc.AuthorsStanford University LibrariesDescriptionAbstract

Title: Cotality Loan-Level Market Analytics (LLMA)

Cotality Loan-Level Market Analytics (LLMA) for primary mortgages contains detailed loan data, including origination, events, performance, forbearance and inferred modification data. This dataset may not be linked or merged with any of the other datasets we have from Cotality.

Formerly known as CoreLogic Loan-Level Market Analytics (LLMA).

Methodology

Cotality sources the Loan-Level Market Analytics data directly from loan servicers. Cotality cleans and augments the contributed records with modeled data. The Data Dictionary indicates which fields are contributed and which are inferred.

The Loan-Level Market Analytics data is aimed at providing lenders, servicers, investors, and advisory firms with the insights they need to make trustworthy assessments and accurate decisions. Stanford Libraries has purchased the Loan-Level Market Analytics data for researchers interested in housing, economics, finance and other topics related to prime and subprime first lien data.

Cotality provided the data to Stanford Libraries as pipe-delimited text files, which we have uploaded to Data Farm (Redivis) for preview, extraction and analysis.

For more information about how the data was prepared for Redivis, please see Cotality 2024 GitLab.

Usage

Per the End User License Agreement, the LLMA Data cannot be commingled (i.e. merged, mixed or combined) with Tax and Deed Data that Stanford University has licensed from Cotality, or other data which includes the same or similar data elements or that can otherwise be used to identify individual persons or loan servicers.

The 2015 major release of Cotality Loan-Level Market Analytics (for primary mortgages) was intended to enhance the Cotality servicing consortium through data quality improvements and integrated analytics. See **Cotality_LLMA_ReleaseNotes.pdf **for more information about these changes.

For more information about included variables, please see Cotality_LLMA_Data_Dictionary.pdf.

**

For more information about how the database was set up, please see LLMA_Download_Guide.pdf.

Bulk Data Access

Data access is required to view this section.

Facebook

Facebook Twitter

TwitterCC0 1.0 Universal Public Domain Dedicationhttps://creativecommons.org/publicdomain/zero/1.0/

License information was derived automatically

🇪🇺 유럽연합